What is ACH?

August 27, 2018

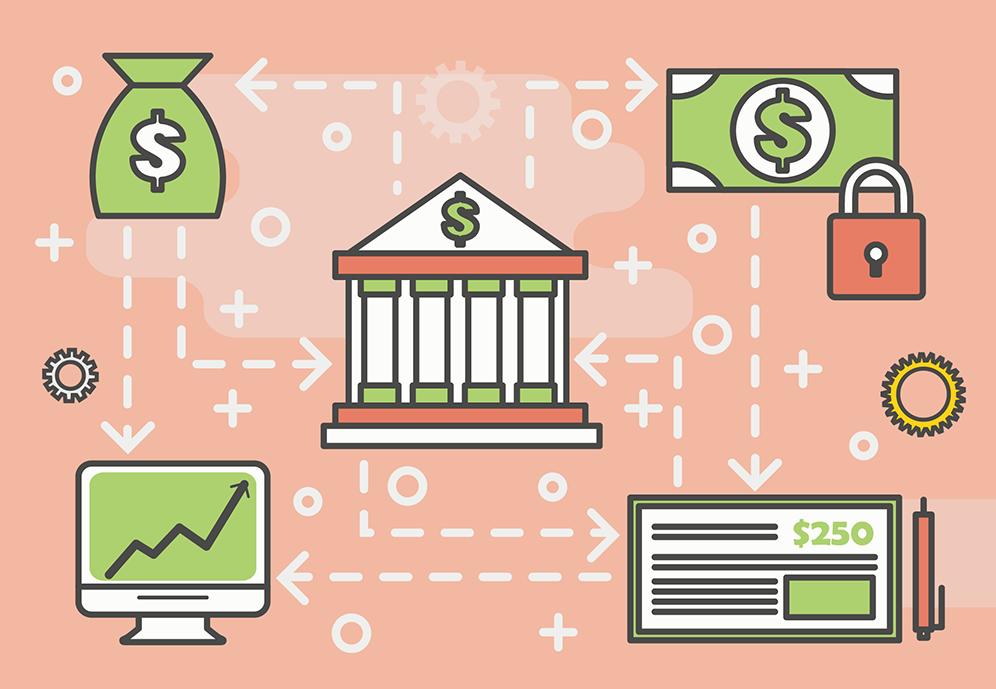

ACH payments are electronic payments made through the Automated Clearing House network. Funds move from one bank account to another with the help of an intermediary that routes funds to the final destination. This type of payment can provide benefits for both merchants and consumer. They are inexpensive, they can be automated and record keeping is easier with electronic payments. ACH payments are electronic transfers from one bank account to another. Some of the common uses are:

- A customer pays a service provider

- A consumer moves funds from one bank to another

- A business pays a supplier for products

To complete these payments, the organization requesting the payment, needs to get the bank account information from the other party involved:

- The type of account at the bank

- The bank’s ABA routing number

- The recipient’s account number

With that information, a payment can be created and routed to the correct account.

Benefits

- These payments are electronic, ACH payments use fewer resources.

- Electronic transactions make it easier to keep track of income and expenses. With every transaction, banks create an electronic record.

- Long distance payments, business can accept payments by ACH remotely.

Source: The Balance.